Side Hustle Taxes: Do You Need to Declare Extra Income?

Earning extra cash? Nolan explains Side Hustle Taxes in SA. Learn when to declare, how to claim deductions, and avoid penalties from SARS.

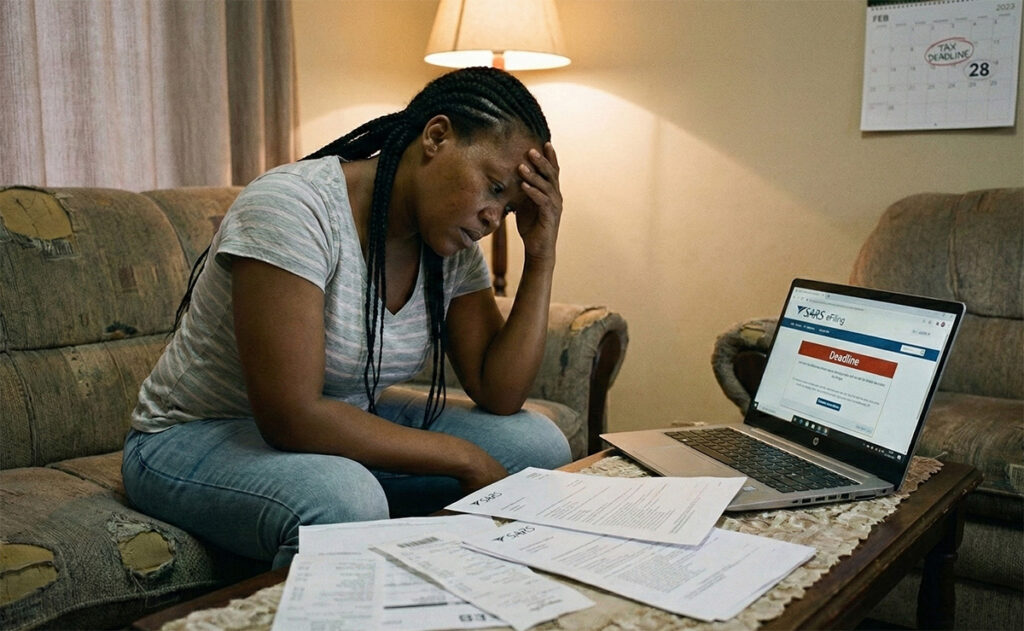

South Africa has become a nation of hustlers. We have accountants who bake wedding cakes on weekends, teachers who teach English online at night, and IT guys who drive Uber on Saturdays. In an economy where the cost of living keeps climbing, having a “side hustle” isn’t just a trend; for many, it is a survival strategy.

But there is a shadow looming over that extra cash in your bank account. A question that makes many people nervous: “Do I have to tell SARS about this?”

The braai-side advice usually goes something like this: “Ag, don’t worry, man. It’s just a bit of cash. SARS only cares about the big guys.”

I’m Nolan, and I am here to tell you that this advice is dangerous. In the age of AI and digital banking, SARS knows more than you think. Side hustle taxes are real, and ignoring them can turn your financial freedom journey into a nightmare of penalties and audits.

Today, we are going to clear the air. We will look at exactly when you need to declare, how to do it without losing your mind, and—crucially—how you can use legitimate deductions to pay less tax legally.

The Golden Rule: All Income is Income

Let’s start with the hard truth. According to the Income Tax Act, “Gross Income” includes the total amount, in cash or otherwise, received by or accrued to you.

It does not matter if:

- You were paid in cash.

- You were paid via PayPal or Payoneer.

- You were paid in Bitcoin.

- It is “just a hobby.”

If you are trading—meaning you are selling goods or services with the intention of making a profit—that money is taxable. Whether you are selling vintage clothes on Yaga or consulting on Upwork, SARS wants their slice.

The Myth of the “R95,750 Threshold”

There is a common misunderstanding about the tax threshold.

- Fact: If you are under 65, you only start paying tax if you earn more than R95,750 per year (the 2025 tax threshold).

- The Confusion: People think, “My side hustle only makes R50,000, so I don’t have to declare it.”

- The Reality: That threshold applies to your TOTAL taxable income.

Example:

- You earn a salary of R300,000 (Your main job).

- You earn R40,000 from your side hustle.

- Total Income: R340,000. Because your total is above the threshold, every cent of that R40,000 side hustle money is taxable at your marginal tax rate. You cannot view the side hustle in isolation.

Meet “Provisional Tax” (It’s Not as Scary as It Sounds)

This is the term that makes people panic. If you earn income that is not subject to PAYE (Pay-As-You-Earn), and that income exceeds R30,000 per year, you automatically become a Provisional Taxpayer.

What does this mean? It doesn’t mean you pay more tax. It just changes when you pay it.

- Normal Employee: Your boss deducts tax every month.

- Provisional Taxpayer: You must file a return and pay tax twice a year (August and February) to cover your non-salary income.

If you don’t register as a provisional taxpayer and you just wait until the end of the year to file, SARS can hit you with “underestimation penalties.” It is a vital part of mastering personal finance in SA—being proactive rather than reactive with your tax bills.

The Good News: Deductions!

This is the fun part. If you have to declare the income, you also get to declare the expenses. You only pay tax on the profit (Income minus Expenses), not the revenue.

What can you deduct? Generally, any expense “actually incurred in the production of income” is deductible.

- The Baker: Ingredients, electricity (if measurable), packaging, delivery fuel.

- The Freelancer: Software subscriptions (Adobe, Canva), domain hosting, data costs.

- The Uber Driver: Petrol, vehicle maintenance, insurance, car wash, mints for passengers.

Nolan’s Warning: You must keep receipts. A bank statement is often not enough. You need the invoice. Create a simple Google Drive folder and photo every slip immediately.

The Home Office Deduction (Handle with Care)

Since 2020, everyone wants to claim their home office. SARS is extremely strict here. To claim a portion of your rent/bond and electricity, you must have a room that is:

- Specifically equipped for your trade.

- Used regularly and exclusively for that trade.

If you work from your dining room table or a desk in your bedroom, you cannot claim. If you try, and you get audited, they will disallow it and fine you.

Turnover Tax: The Secret Weapon for Small Hustles

If your side hustle is growing but still makes under R1 million per year, you might qualify for Turnover Tax. This is a simplified tax system for micro-businesses.

- The Benefit: The rates are much lower.

- If you make under R335,000 a year, the tax rate is 0%.

- If you make between R335,001 and R500,000, the rate is just 1% of taxable turnover.

- The Trade-off: You cannot claim deductions (expenses). You are taxed on your turnover (total sales), not your profit.

- Who is it for? Businesses with high profit margins and low expenses (like consulting or tutoring). If you have high expenses (like buying stock to resell), the standard tax system might be better.

You can read more about the specific tables and requirements on the SARS Turnover Tax page.

Ring-Fencing: What If My Side Hustle Loses Money?

Some people start a side hustle just to create a “tax loss” to lower their salary tax. SARS knows this trick. It is called Ring-Fencing Assessed Losses.

If your side hustle makes a loss (Expenses > Income), SARS might stop you from offsetting that loss against your salary if:

- You are in the top tax bracket.

- The “business” has made a loss for 3 out of 5 years.

- It looks like a hobby (e.g., photography, gambling, animal breeding).

Basically, if your side hustle is actually just an expensive hobby, SARS won’t subsidise it.

The Risks of Not Declaring

“But Nolan, how will they know?”

- Third-Party Data: Banks now share more data with SARS. If you have R20,000 flowing into your account every month from “Clients,” the AI flags it.

- Lifestyle Audits: If you declare R20,000 a year but you bought a R800,000 car cash, the math doesn’t math.

- The Whistleblower: Often, it is a jealous ex-partner or a disgruntled former employee who reports you.

The penalty for tax evasion can be up to 200% of the tax due, plus interest, plus a criminal record. It is simply not worth the stress.

Step-by-Step: How to Get Compliant

Don’t panic. You can fix this.

Step 1: Separate Your Money

Open a separate bank account for your side hustle. (A cheap account like Capitec or TymeBank is fine).

- All side hustle income goes in there.

- All side hustle expenses come out of there. This makes tax season 100x easier because you don’t have to sift through your personal Spar and Netflix transactions to find business costs.

Step 2: Register for eFiling

Ensure your eFiling profile is active. You usually don’t need to register a separate company (Pty Ltd) for a side hustle; you can trade as a “Sole Proprietor” using your personal income tax number.

Step 3: Keep a “Tax Logbook”

Use a simple Excel spreadsheet or an app. Columns: Date | Description | Income Amount | Expense Amount | Category. Update it once a week. Do not leave it for February 28th!

Step 4: Save for the Taxman

A general rule of thumb for side hustlers: Save 25% of your profit. Put this in a separate savings account. Do not touch it. When August comes and you have to pay Provisional Tax, you will have the cash ready. If you saved too much, congrats—you have a bonus!

The Price of Growth

Paying side hustle taxes is painful, I know. Nobody likes seeing their hard-earned cash go to the government. But look at it this way: Paying tax means you are making money.

It means your business is real. It means you have “proof of income” if you ever want to buy a car or a house using your side hustle earnings. You cannot ask the bank for a home loan based on “under the table” cash.

Legitimize your hustle. Declare your income. Claim your deductions. That is how you move from a “struggler” to a CEO.

FAQ: Side Hustle Tax Questions

Do I have to register a company (Pty Ltd) to have a side hustle? No. You can trade as a Sole Proprietor. It is the simplest and cheapest way. You and the business are the same legal entity. You declare the income on your personal ITR12 return under “Local Business, Trade and Professional Income.”

What about VAT? You only have to register for VAT if your turnover (sales) exceeds R1 million in a 12-month period. If you earn less than that, you don’t need to worry about charging VAT.

I teach English online to overseas students. Is that taxed in SA? Yes. If you are a tax resident in South Africa, you are taxed on your worldwide income. It doesn’t matter if the money comes from China or the USA; if you live here, you declare it here.