Coping with Retrenchment: Rights, Resources, and Next Steps

Retrenched? Don't panic. Zama explains your Section 189 rights, how to claim UIF, calculate severance pay, and bounce back in the SA job market.

There are few words in the South African corporate vocabulary as cold or terrifying as “Section 189.”

Retrenchment is not just a career stall; it is a traumatic life event. It strikes at your financial security, your daily routine, and your sense of identity. In 2026, with global economic headwinds shifting the landscape of mining, banking, and retail, large-scale restructuring has become an unfortunate reality. If you are facing this uncertainty, know this: Retrenchment is a business process, not a reflection of your personal worth.

However, panic is your enemy. While you process the emotional shock, you must simultaneously activate your strategic brain. You have specific rights under South African Labour Law, and there are resources designed to catch you. To understand why these shifts are happening in your sector, start by reading our analysis on navigating the South African job market, which provides the macroeconomic context to these personal challenges.

This guide serves as your survival manual, breaking down the legal process of Section 189, how to maximize your severance, and how to pivot to your next chapter.

The Legal Framework: Understanding Section 189

In South Africa, an employer cannot simply fire you because they are “cutting costs.” They must follow a rigorous procedure outlined in the Labour Relations Act (LRA). If they deviate from this, the dismissal may be deemed unfair, and you could be entitled to compensation.

1. The Notice (Section 189(3) Letter)

The process starts when you receive a written notice inviting you to consult. This is not a termination letter. It is an invitation to discuss potential retrenchments.

- What it must contain: The reasons for the proposed retrenchment, the alternatives considered, the number of employees likely to be affected, and the proposed method for selecting those employees.

2. The Consultation Process

This is your opportunity to speak. Whether represented by a union or acting individually, you have the right to suggest alternatives to dismissal (e.g., salary cuts, reduced hours, or bumping).

- Zama’s Tip: Do not stay silent. Ask for the company’s audited financial statements. If they claim “financial distress,” they must prove it.

3. Selection Criteria (LIFO)

If retrenchment is unavoidable, the selection criteria must be fair and objective. The most common method in SA is LIFO (Last In, First Out). If you have been there 10 years and they keep the guy who started last month (in the same role), you have grounds for a dispute at the CCMA.

The Financial Package: What Are You Owed?

When the consultation ends and the termination is confirmed, the conversation shifts to money. You need to ensure you get every cent you are legally owed.

Severance Pay

By law (BCEA), you are entitled to one week’s pay for every completed year of service.

- Example: If you worked there for 10 years and earn R20,000 a week, your minimum statutory severance is R200,000.

- Note: If you unreasonably refuse an offer of alternative employment within the company, you forfeit this severance pay.

Outstanding Leave and Notice Pay

- Leave: All accumulated annual leave must be paid out in cash.

- Notice Pay: If the company does not want you to work your notice period (e.g., 30 days), they must pay you out for that month in lieu of notice.

The Tax Implication

Here is the silver lining. SARS offers a “Severance Benefit” tax break. As of the 2026 tax year, the first R500,000 of your severance lump sum (lifetime limit) is generally tax-free. Ensure your employer applies for a Tax Directive from SARS to ensure you don’t get over-taxed on payout day.

Zama’s HR Secret: Don’t just accept the statutory minimum. If the company is retrenching to “restructure” rather than due to bankruptcy, there is often room to negotiate. Ask for a “Voluntary Severance Package” (VSP) that includes 2 weeks’ pay per year of service, or extended medical aid cover for 3 months. Everything is negotiable.

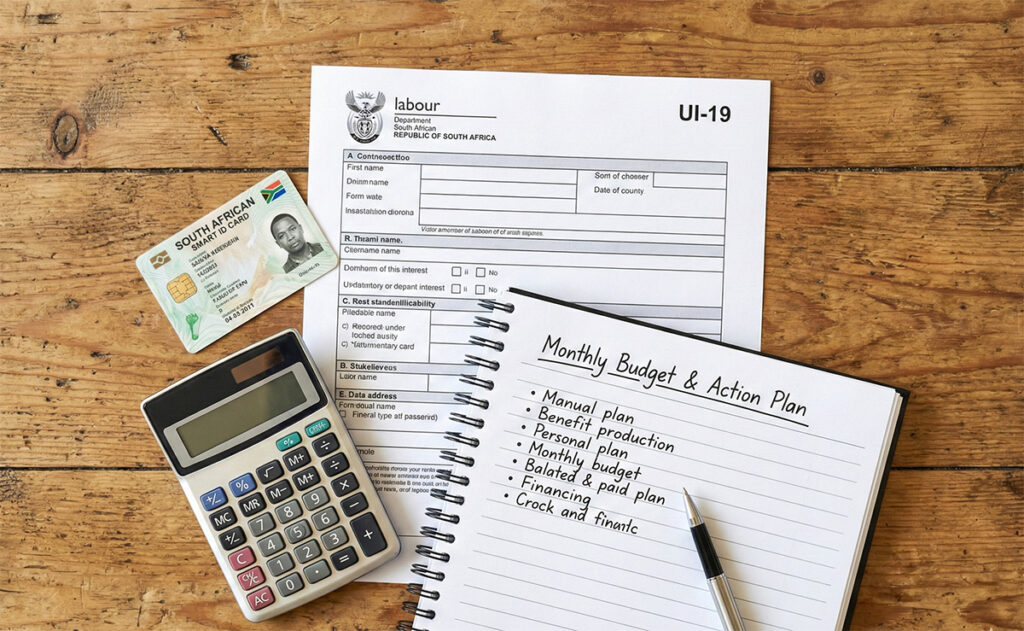

Your Survival Kit: UIF and Emergency Funds

Once the salary stops, the clock starts ticking.

1. Claiming UIF (Unemployment Insurance Fund)

You have contributed 1% of your salary to this fund every month. Now is the time to use it.

- Register Immediately: Do not wait. Register on uFiling.

- Documents Needed: UI-19 (Employer declaration), UI-2.8 (Bank form), and your ID. Ensure your employer submits the UI-19 electronic declaration to the Department of Labour before you leave the building.

- The Payout: It operates on a sliding scale (38% to 60% of your salary) capped at a ceiling. It is not a full salary replacement, but it buys you groceries.

2. Protecting Your Pension

The temptation to cash out your entire Provident/Pension fund is overwhelming. Resist this.

- The Tax Trap: If you withdraw your pension now, you will be taxed heavily (withdrawal tax tables are aggressive).

- The Strategy: Transfer it to a “Preservation Fund.” This freezes the tax liability and keeps your retirement savings growing. Only access a small portion if it is a matter of survival.

If you don’t have savings yet, this crisis highlights why liquid cash is king. For the future, use our guide on how to build an emergency fund in ZAR to ensure you are never caught off guard again.

Psychological Recovery: The “Grief Cycle”

Retrenchment triggers the same psychological stages as grief: Denial, Anger, Bargaining, Depression, and Acceptance.

- Denial: “Maybe they will call me back.” (They won’t).

- Anger: “After all I did for them!” (Channel this energy into your job hunt).

- Acceptance: “I am now the CEO of My Career Pty Ltd.”

Do not hide your retrenchment. In 2026, there is no stigma. Post about it on LinkedIn. The South African community is incredibly supportive. A post saying “I was affected by the Section 189 at [Company]. I am now open to roles in X” often goes viral and leads to interviews.

Monday Morning Checklist: The Comeback Plan

The week after you leave is critical. Do not sleep in. Keep a routine.

- Monday 08:00: Log onto SARS eFiling to check your tax status. You need a clean tax record for your next background check.

- Monday 10:00: File your claim on uFiling. The system is slow; get it done early.

- Tuesday: Request a “Certificate of Service” and a written reference letter from your line manager. Do this before they forget your achievements.

- Wednesday: Update your CV. Remove the “current” job end date and change it to the month you left. Update your “Open to Work” status on LinkedIn.

FAQ: Retrenchment Questions

Can I take my employer to the CCMA? Yes. If you believe the process was unfair (procedurally) or there was no valid reason (substantively), you have 30 days from the date of dismissal to refer a dispute to the CCMA.

Does retrenchment look bad on a CV? No. It is structurally different from being fired for misconduct. In your interview, simply state: “The company underwent a structural reorganization due to economic constraints, and my role was made redundant.”

How long does UIF take to pay out? In an ideal world, 4-6 weeks. In reality, it can take 8-12 weeks due to backlogs. Plan your budget accordingly.

Can I get my severance pay if I resign before the process ends? Generally, no. If you resign, you leave voluntarily. You usually need to stay until the official termination date to qualify for the severance package and UIF.

Retrenchment is a bruise, not a tattoo. It heals. Many of South Africa’s most successful entrepreneurs and executives started their greatest chapters the day after they were let go.