Practical Budgeting Tips for Low Earners: Save Smart, Live Better

Discover practical budgeting tips for low-income earners to save money, manage expenses, and build financial stability. Learn to prioritize and plan effectively!

Managing finances on a small income can feel overwhelming, especially when expenses seem to outpace earnings. However, effective budgeting is not only possible but also empowering. By adopting practical strategies, even individuals with limited salaries can manage their money wisely and achieve financial stability.

This guide will explore realistic budgeting techniques tailored for low earners, enabling them to tackle financial challenges, save efficiently, and foster confidence in their financial futures.

Understanding Your Financial Situation

To create an effective budget, start by understanding your financial landscape. Knowing how much money comes in and where it goes is the foundation of financial planning.

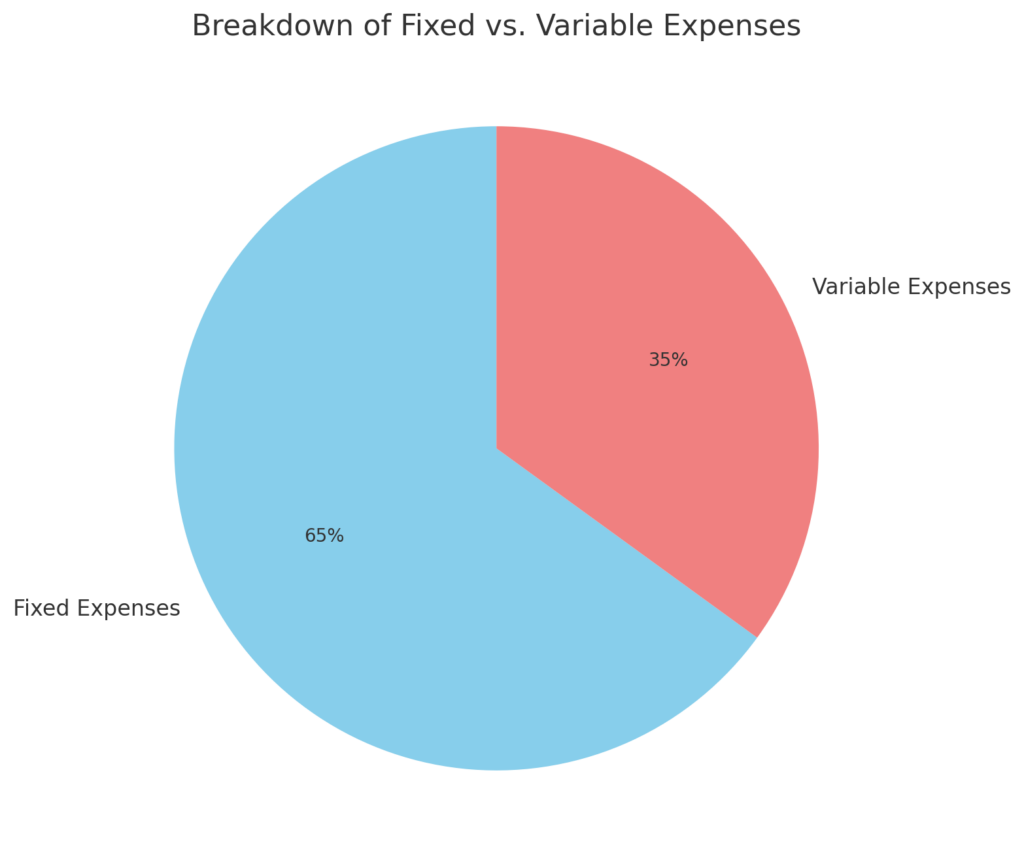

- Track Your Income and Expenses: Record all sources of income, including salaries, side hustles, or government benefits. Similarly, categorize your expenses as fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment).

- Use Budgeting Tools: Spreadsheets or apps like Mint or PocketGuard can simplify tracking and highlight spending patterns. Visual tools can make financial insights easier to grasp.

- Analyze Spending Patterns: Identify unnecessary expenses and areas for potential savings. For example, are you paying for subscriptions you rarely use?

By gaining a clear view of your financial situation, you can build a realistic and achievable budget.

Creating a Realistic Budget

A good budget reflects your income and accommodates your financial priorities.

- Choose a Budgeting Framework: Methods like the 50/30/20 rule (50% needs, 30% wants, 20% savings) are popular but might not suit everyone. Low earners may prefer a 70/20/10 approach (70% needs, 20% savings, 10% wants).

- Set Clear Categories: Allocate funds for essentials, discretionary spending, and savings. Ensure your essential expenses are fully covered before focusing on other areas.

- Revisit and Adjust: Regularly review your budget to reflect changes in income or expenses.

| Rule | Category | Percentage | Example Allocation (R$) |

|---|---|---|---|

| 50/30/20 | Essentials | 50% | 2.500 |

| Wants | 30% | 1.500 | |

| Savings/Debt Repayment | 20% | 1.000 | |

| 70/20/10 | Essentials | 70% | 3.500 |

| Savings/Investments | 20% | 1.000 | |

| Discretionary Spending | 10% | 500 |

Prioritizing Needs Over Wants

Understanding the difference between needs and wants is crucial for effective budgeting.

- Categorize Expenses: List all monthly expenses and label them as needs (e.g., housing, groceries) or wants (e.g., dining out, streaming services).

- Focus on Essentials: Ensure rent, utilities, and food are prioritized in your budget.

- Adopt Cost-Saving Measures: Buy groceries in bulk, opt for public transport, and cook at home to cut unnecessary costs.

Cutting Down on Unnecessary Expenses

Small changes in spending habits can lead to significant savings.

- Cancel Unused Subscriptions: Review all subscriptions and eliminate those you don’t use regularly.

- Embrace Home Cooking: Dining out can be expensive. Meal planning and bulk cooking can save money and reduce waste.

- Opt for Affordable Alternatives: Switch to generic brands, utilize coupons, and shop at local markets.

Setting Up an Emergency Fund

An emergency fund is a critical safety net for unexpected expenses.

- Start Small: Save a small portion of each paycheck, even if it’s just $10.

- Use a Dedicated Account: Keep your emergency fund separate from regular accounts to avoid temptation.

- Automate Savings: Set up automatic transfers to ensure consistent contributions.

Utilizing Discounts and Coupons

Maximize your savings by taking advantage of discounts and deals.

- Explore Coupon Platforms: Websites like Coupons.com and apps like Flipp offer deals on groceries and household items.

- Join Loyalty Programs: Many retailers provide discounts for repeat customers.

- Plan Purchases Around Sales: Shop during promotions and stock up on essentials when prices drop.

Finding Additional Sources of Income

Boost your earnings by exploring side opportunities.

- Freelancing: Offer skills like writing, graphic design, or tutoring on platforms like Upwork.

- Part-Time Work: Consider flexible roles in retail or hospitality that fit your schedule.

- Monetize Hobbies: Turn crafting, baking, or photography into a source of income.

Saving on Utilities and Bills

Lowering utility expenses can free up additional funds.

- Implement Energy-Saving Practices: Use energy-efficient bulbs and unplug devices when not in use.

- Negotiate Rates: Contact service providers to explore discounts or better plans.

- Set Reminders for Bills: Avoid late fees by paying bills on time using digital reminders.

Reviewing Your Budget Regularly

Budget reviews help keep your financial goals on track.

- Schedule Monthly Check-Ins: Assess your spending and adjust for any changes.

- Identify Trends: Look for recurring overspending patterns and address them.

- Celebrate Milestones: Acknowledge progress, like reducing debt or meeting savings goals.

Conclusion: Take Control of Your Finances

Budgeting on a low income is challenging but achievable. By understanding your financial situation, prioritizing needs, and adopting smart saving practices, you can build a stable financial future. Start small, stay consistent, and remember that every step counts.

Want more actionable advice? Check out our A Practical Guide to Mastering Financial Organization and Boosting Money Management for practical tips to optimize your financial habits and achieve long-term goals.